Introduction

Starting and growing a successful business requires more than just a great idea—it requires the right financial tools. One of the essential partners in building your business empire is a solid banking relationship. Business Empire Bank is a bank specifically designed to help entrepreneurs and business owners with the financial tools and resources they need to succeed. Whether you’re just starting out or scaling up, having the right banking products can make all the difference. In this article, we’ll explore the key financial tools offered by Business Empire Bank to help you build your dream business.

The Importance of a Strong Financial Foundation

Building a business empire isn’t just about hard work; it’s also about having a financial strategy in place. Understanding your financial needs is crucial, as it allows you to make informed decisions about how to allocate resources effectively. A solid financial foundation enables your business to weather economic fluctuations, pursue growth opportunities, and manage risks with confidence. It’s like laying the first brick of a strong building—the rest of your success is built on that base.

Setting Up Your Business Account

When it comes to managing business finances, the first step is setting up the right accounts. Many entrepreneurs make the mistake of using their personal accounts for business transactions, but this can lead to complications. With Business Empire Bank, you can easily open a business checking account tailored to your specific needs. Business checking accounts are designed to handle higher transaction volumes and offer features like fraud protection and seamless integration with accounting tools.

Choosing the right business account is also important. A simple checking account may be enough for small businesses, but larger enterprises may need specialized accounts for handling payroll, taxes, and other financial tasks. By separating personal and business finances, you’ll not only stay organized, but also have a clear view of your company’s financial health.

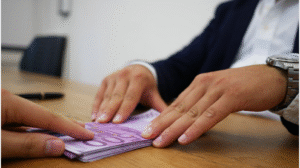

Business Loans: Fueling Your Growth

One of the most crucial financial tools for growing a business is access to loans. Business Empire Bank offers various types of business loans to help entrepreneurs with everything from purchasing equipment to expanding operations. There are several types of loans you can apply for, such as term loans, lines of credit, or equipment financing.

When applying for a business loan, it’s important to understand your financing needs and your ability to repay. The application process generally involves submitting financial statements, a business plan, and details about your creditworthiness. Loans can help you bridge gaps in your cash flow or finance large capital expenditures, allowing you to scale your business more quickly.

Credit Lines: The Flexible Option

A business line of credit provides flexible access to funds when you need them most. Unlike a traditional loan, where you receive a lump sum upfront, a line of credit allows you to borrow up to a certain limit and only pay interest on the amount you’ve borrowed. Business Empire Bank offers various credit lines with competitive interest rates, making them an excellent option for businesses that need short-term funding or want to be prepared for unexpected expenses.

The key to using a credit line effectively is to borrow responsibly. It’s best used for covering ongoing operational expenses, such as inventory purchases or payroll, rather than long-term investments. Credit lines are also ideal for managing cash flow fluctuations, which are common in many industries.

Merchant Services: Streamlining Payments

In today’s digital age, customers expect fast and secure payment options. Business Empire Bank provides merchant services that allow businesses to accept payments in various forms, including credit cards, debit cards, and digital wallets. These services are crucial for any business looking to expand its customer base and offer seamless transactions.

Choosing the right merchant services provider is key to ensuring that payments are processed efficiently and securely. With Business Empire Bank, you’ll benefit from a reliable payment gateway that integrates with your accounting system, making it easier to track sales and manage finances.

Business Credit Cards: A Handy Tool for Expenses

Business credit cards are an essential tool for managing day-to-day expenses. These cards provide a convenient way to separate business expenses from personal ones, which simplifies accounting and tax filing. Additionally, business credit cards often offer rewards and cash-back programs that can benefit your business.

When selecting a business credit card, consider factors like interest rates, annual fees, and available perks. Using a credit card responsibly, paying off balances on time, and keeping track of expenditures will help you maintain a positive credit history and avoid debt.

Online Banking: Convenience at Your Fingertips

As a business owner, time is precious, and convenience matters. Online banking from Business Empire Bank allows you to manage your accounts from anywhere, anytime. You can check your balance, pay bills, transfer funds, and even access reporting tools that help you track your business finances in real-time.

Online banking is not only convenient but also secure. With robust encryption and multi-factor authentication, your financial data is protected, allowing you to focus on running your business without worrying about security threats.

Accounting and Budgeting Tools

To run a successful business, you need to know where your money is going. Accounting software and budgeting tools are essential for tracking income, expenses, and overall financial performance. Business Empire Bank partners with accounting software providers, offering integration that simplifies financial management.

By using these tools, you can create accurate financial statements, set budgets, and even forecast future growth. These insights will help you make informed decisions about your business’s direction and keep you on track toward achieving your goals.

Tax Tools and Resources

As a business owner, you must stay on top of your tax obligations. Business Empire Bank provides various tax tools to help you manage your taxes efficiently. From estimating quarterly taxes to filing returns, these tools simplify the process and ensure compliance.

Additionally, working with financial experts at the bank can help you develop a tax strategy that minimizes liabilities and maximizes deductions, ensuring that you keep more of your hard-earned profits.

Insurance: Protecting Your Business

Running a business comes with risks, and it’s important to protect your assets. Business Empire Bank offers a range of insurance products, from general liability insurance to workers’ compensation and property coverage. Insurance can help safeguard your business from unforeseen events, such as accidents, lawsuits, or natural disasters.

Having the right insurance in place ensures that your business can continue to operate smoothly even in the face of adversity.

Investment Accounts: Building Long-Term Wealth

Investing your business profits is an important step in building long-term wealth. Business Empire Bank offers various investment accounts, such as retirement plans for business owners or high-yield savings accounts. These accounts allow you to grow your business’s financial resources and prepare for future challenges.

A financial advisor can help you decide the best investment strategy for your business, ensuring that your money works for you.

Building Your Credit Score

A strong business credit score is essential for securing financing and favorable loan terms. Business Empire Bank offers tools and resources to help you monitor and improve your business credit score. Steps such as paying bills on time, reducing debt, and maintaining a low credit utilization rate can help boost your score over time.

Managing Cash Flow Effectively

Cash flow management is one of the biggest challenges faced by business owners. Proper forecasting and budgeting can help you stay ahead of potential cash flow issues. Business Empire Bank offers cash flow management tools that help you track and project cash inflows and outflows, so you can make adjustments as needed to keep your business running smoothly.

Conclusion

The financial tools offered by Business Empire Bank can be the key to building and growing your business empire. From business loans and credit lines to insurance and investment accounts, these tools are designed to help entrepreneurs succeed in today’s competitive market. With the right financial foundation, you can make informed decisions, manage risks, and achieve long-term growth.

FAQs

- What is the difference between a personal and a business bank account? A business bank account is specifically designed to handle business transactions, while a personal account is for individual use. Using a business account keeps finances organized and separate.

- How do I apply for a business loan? To apply for a business loan, you’ll need to submit financial documents, a business plan, and proof of your creditworthiness. The bank will assess your eligibility based on these factors.

- What is a business line of credit? A business line of credit is a flexible loan option that allows you to borrow money up to a specified limit and only pay interest on the amount used.

- Can I use business credit cards for personal expenses? No, business credit cards should only be used for business-related expenses to maintain clear financial records and avoid confusion during tax season.

- How can I improve my business credit score? Pay your bills on time, reduce your business debt, and monitor your credit regularly. These steps can help improve your score over time.

Be First to Comment